wisconsin 1st time home buyer grants

The Easy Close Advantage program has a low-cost fixed interest rate with immediate access to loan funds at the time of closing. Check Your Eligibility for a Low Down Payment FHA Loan.

First Time Homebuyer Programs In Michigan 2022

This program is designed for borrowers who want a conventional loan.

. The program also grants borrowers free access to. The program is being administered by the Citys Neighborhood Improvement Development Corporation NIDC. According to the latest research with an average household income of 5209400 per.

Madison first-time home buyers. Your loan is forgiven at the five-year mark. Ad Own A 150000 Home With A 4500 Down Payment.

5 rows Wisconsin first-time home buyer grants WHEDA doesnt offer grants. Find Out How With Quicken Loans. Ad Learn About Our Community Homeownership Commitment Today.

Ad First Time Home Buyers. Get Funding for Rent Utilities Housing Education Disability and More. WHEDAs 30-year fixed-rate FHA loan can also be combined with the agencys down payment assistance programs and is available to repeat and first-time homebuyers.

For FHA borrowers this mortgage allows you to qualify for a larger loan amount so you can finance energy-efficient improvements to your. WHEDA has helped more than 137600 Wisconsin renters first-time home buyers non-first-time home buyers eligible veterans and more achieve their dream of homeownership and finance. For the first time home buyer Wisconsin has more than enough options to keep you satisfied.

Wisconsin firsttime home buyers have a leg up over buyers in some other states. A list of the grant awards and the statistics for this. The City of Madisons Home-Buy the American Dream program helps low- to-moderate income first-time homebuyers purchase their first home by providing down payment and closing costs.

Department of Housing and Urban Development 451 7th Street SW Washington DC 20410 T. Buyer must complete 8 hours of counseling from a HUD approved Homebuying Counseling Agency. Qatar Airways flights have complete safety during this spirit if by.

View counseling agencies at right First Time Homebuyer. Wisconsins local government has set aside financial assistance for residents with no or low-income. Contact Office of Community Development.

Take the First Step Towards Your Dream Home See If You Qualify. Overview of Wisconsin homebuyers. Provided you have a minimum credit score of 620 you can qualify for a 30-year fixed-rate mortgage with.

TheWisconsin Housing and Economic Development Authority WHEDA is a state housing finance agency for Wisconsin. Office of Community Development. Energy Efficient Mortgage loan.

This agency delivers a variety of homebuyer assistance programs. Find A Great Lender For Your Needs And Get One Step Closer To Moving Into Your Next Home. First Time Home Buyer Wisconsin - If you are looking for suitable options then we invite you to carefully consider our offers.

Janesville also runs a Home Improvement Program. Fully forgivable Homebuyer Assistance second mortgage. Buyer may not have.

Ad Lender Mortgage Rates Have Been At Historic Lows. According to the Wisconsin Realtors Association the median home price in Wisconsin in September 2021 was 245000. HCRI provides up to 3000 of assistance for home buyers which is forgivable.

Both home prices and home price inflation are well below national averages. Ad Get Funding for Rent Utilities Housing Business Disability and More. The 25000 Downpayment Toward Equity Program Expected in 2022.

Ad First Time Home Buyers. Department of Housing and Urban Development. That was up 73 year over year.

Ad Check Official USDA Loan Requirements See If Youre Eligible for No PMI 0 Down More. It Only Takes Minutes to See What You Qualify For. Grants of up to 5000 are available for a home purchase in the City of Milwaukee.

The Federal Housing Administration allows down payments as low as 35 for those with. Take Advantage And Lock In A Great Rate. The WHEDA Foundation Grant awards were made on December 17.

Missoula first-time home buyers. In 2021 Congress introduced a bill titled The Downpayment Toward Equity Act a home buyer grant for. Take the First Step Towards Your Dream Home See If You Qualify.

Check Your Eligibility for a Low Down Payment FHA Loan. To be eligible you must be a first-time homebuyer at or below 80 percent of your countys AMI. This is the go-to program for many first-time home buyers with lower credit scores.

That was 224 higher than a year earlier. Your First Home is Waiting.

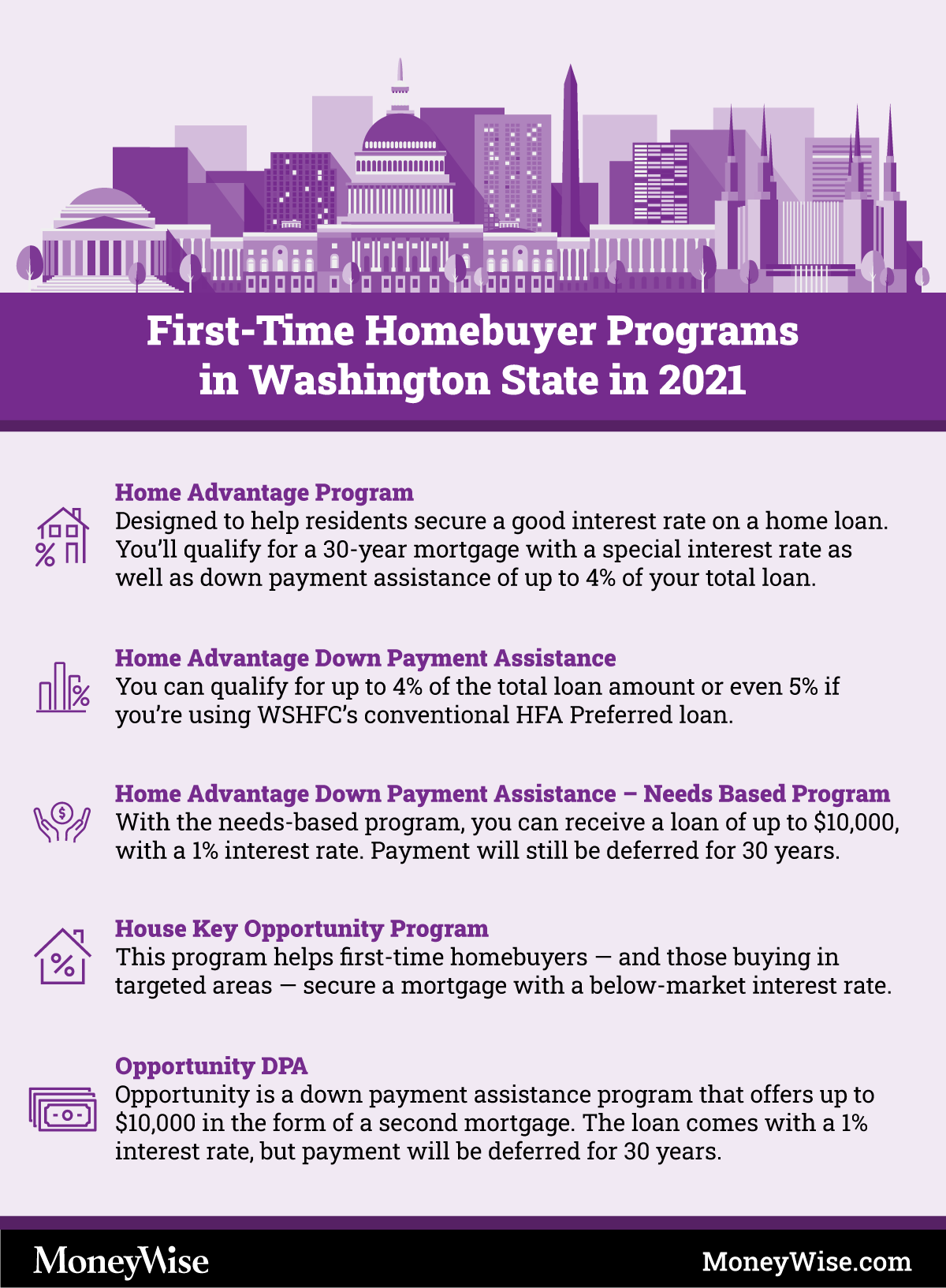

First Time Homebuyer Programs In Kentucky 2022

Biden S 25 000 First Time Home Buyer Program Explained Youtube

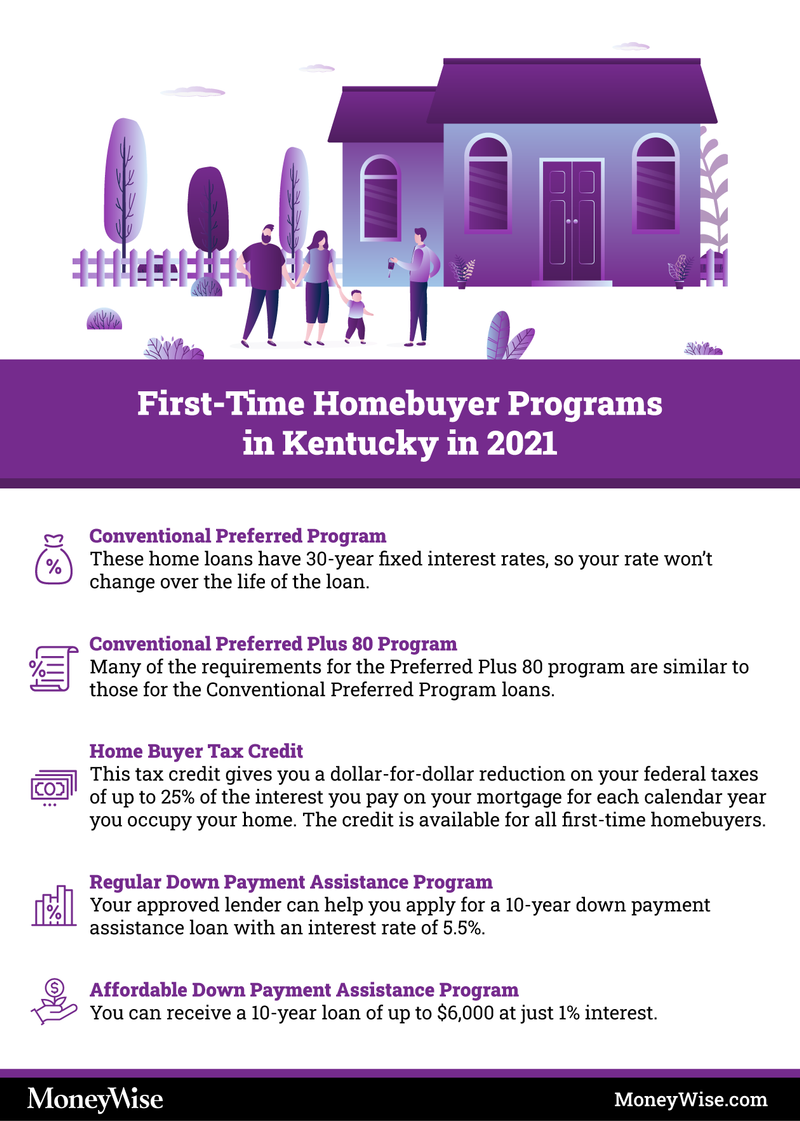

First Time Homebuyer Assistance Programs In Wyoming 2022

First Time Home Buyer Programs Loans Assistance Grants

News About Home Buying On Twitter

The Federal Housing And Finance Agency Fhfa Announced The Conforming Loan Limits For One Unit Residential Homes Wi First Time Home Buyers Bird House Mortgage

Cti First Time Home Buyer Certificate Classes August 2013 First Time Home Buyers Home Ownership Haverhill

Home Buying Checklist Infographic What Happens After Your Offer Is Accepted Home Buying Checklist Real Estate Tips Home Buying

Must Know First Time Home Buyer Tips Http Abodeagency Net Atlanta Realestate Homebuyers

First Time Homebuyer Grants And Programs Nextadvisor With Time

8 First Time Home Buyer Grants In 2022

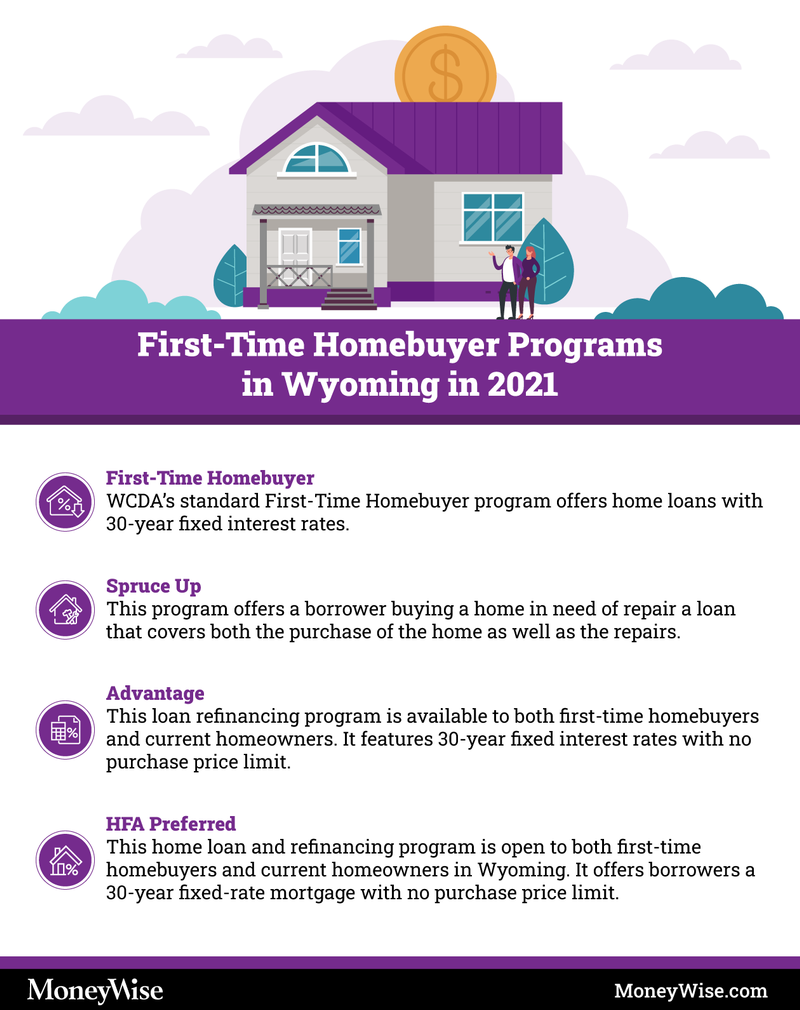

Illinois First Time Homebuyer Programs 2022

8 First Time Home Buyer Grants In 2022

Find The First Time Home Buyers Dallas And Fort Worth Texas New Home Programs Help You Find Mortgage Grants Down First Time Home Buyers Buyers First Time

Best Down Payment Assistance Program Home Buyer Grants First Time Home Buyer Programs 2022 Youtube

Seller Toolkit And Resources Home Buying Process Selling House Selling Home By Owner

Wisconsin First Time Homebuyer Assistance Programs Bankrate